Doanh nghiệp Việt Nam đang sử dụng dịch vụ Headhunter như thế nào?

Hiring developers in Vietnam during 2024–2026 helps businesses optimize costs and access high-quality talent. This article provides pricing by seniority, cost trends, and common IT roles.

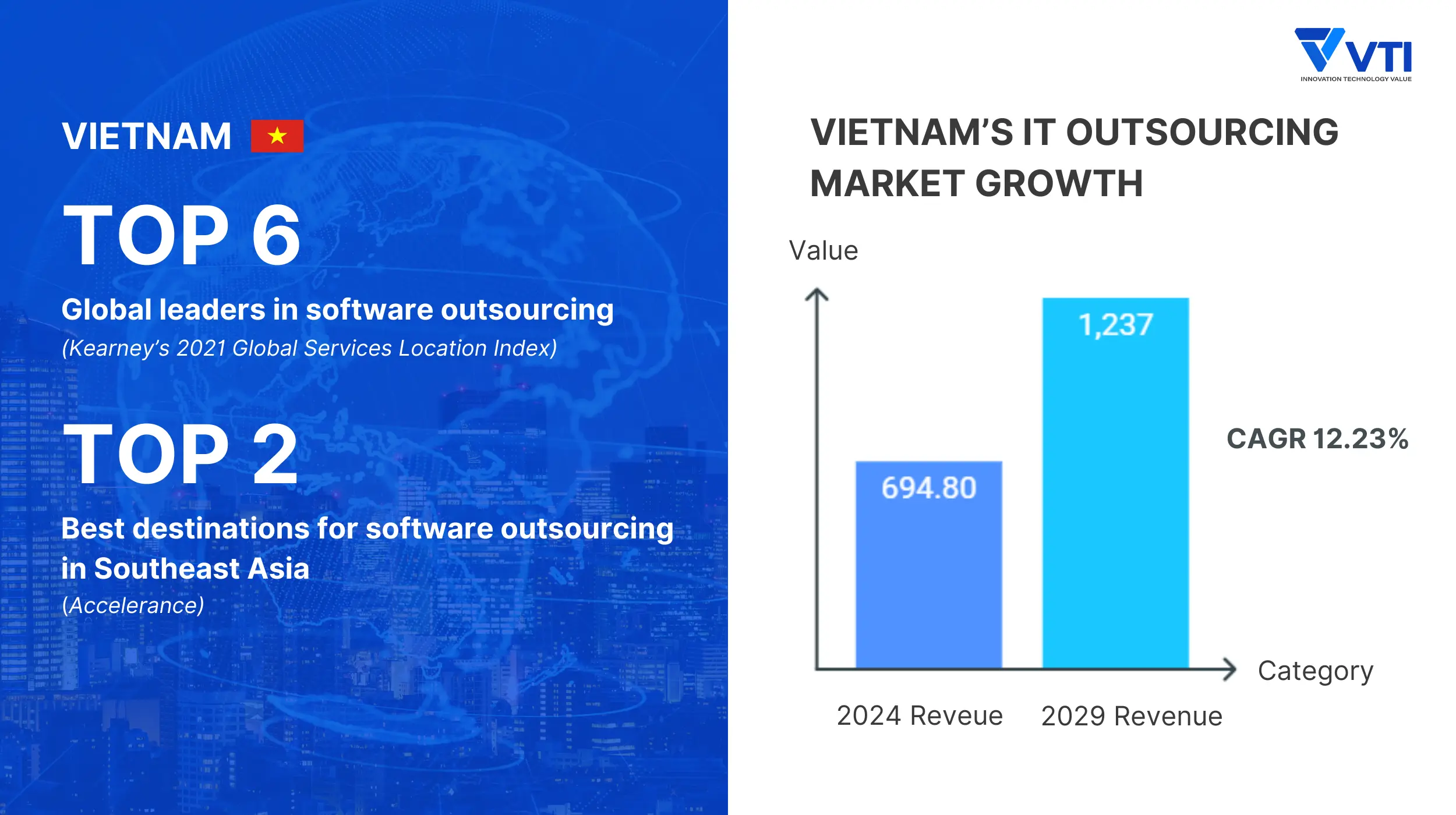

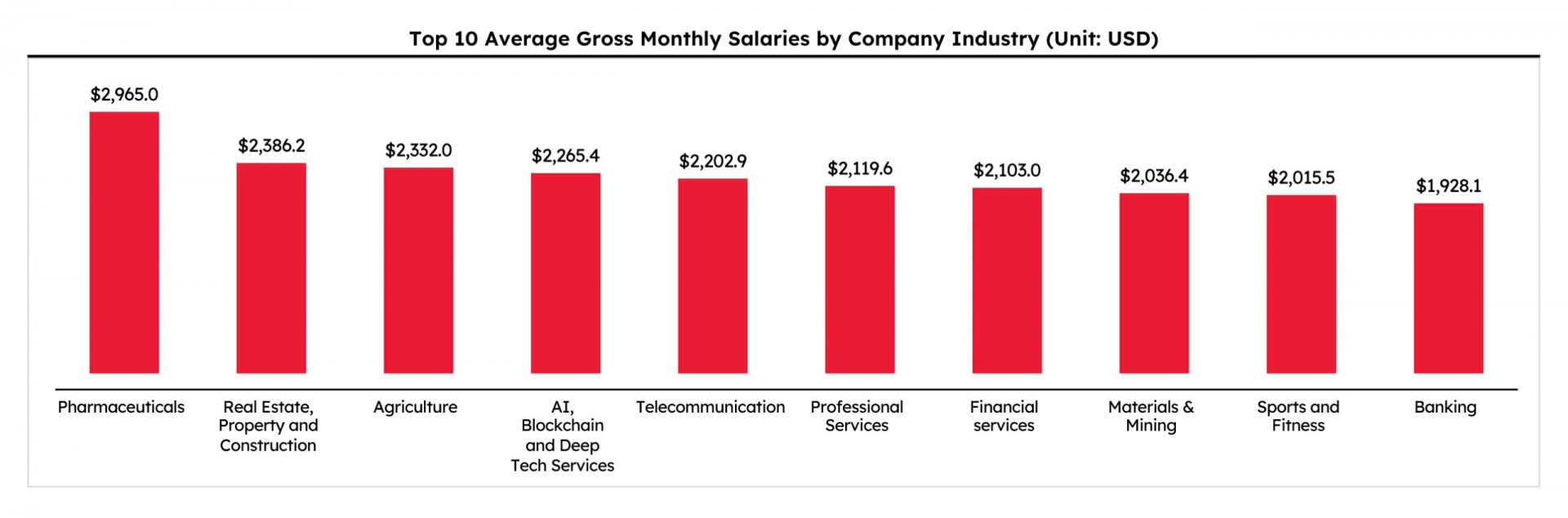

Vietnam’s technology market is growing rapidly, leading to an increasing demand for hiring developers and software engineers during 2024–2026. Domestic and international businesses are choosing Vietnam not only because of the rising quality of talent, but also because developer hiring costs in Vietnam fall within the “most optimal” range in Asia - lower than Singapore & the Philippines, more competitive than Malaysia, yet with quality approaching Thailand and India.

In this article, HRI Vietnam provides a pricing table for hiring developers, analyzes cost trends, and highlights common IT roles so that businesses gain practical insights before starting a project.

>>>> Learn more: IT Bodyshop model between Vietnam – India – Philippines

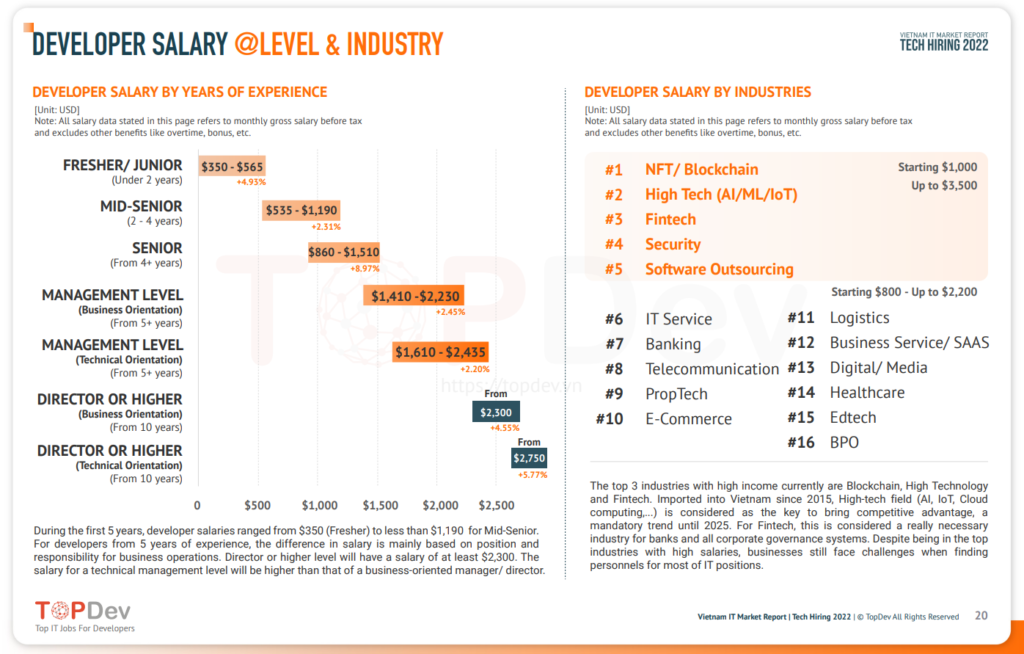

Developer rates vary based on seniority, tech-stack, and the cooperation model (Bodyshop, Outsourcing, Onsite/Remote). These are the average market rates compiled by HRI Vietnam from more than 1,500 IT recruitment quotations:

Highlights: fast learning, agile, low cost

Accounts for 60–70% of outsourcing demand

Higher quality, lower turnover than junior/middle levels

Requires system thinking and 7–10+ years of experience

Each tech-stack has different pricing:

DevOps / Cloud Engineer: demand increasing → prices rising 15–20% per year

This is why businesses come to Vietnam to hire developers monthly or by project, as prices are 40–65% lower than in Singapore, South Korea, or Japan.

1. IT hiring demand increases 12–18% annually

→ Senior-level costs rise slightly 5–10%.

2. Junior – Middle remain stable

→ Due to large supply from Bootcamps & IT universities.

3. AI, Cloud & Data engineers increase sharply

→ Costs may rise 20–30% in the next 2 years.

4. Outsourcing trend (IT Bodyshop) increases strongly

→ Businesses want to save 30–50% compared to full-time hiring.

5.Remote & Hybrid become the standard

→ Reduces office and operational costs.

Overall, Vietnam remains the most cost-competitive developer hiring market in the region, despite slight increases for senior and AI talent.

Businesses primarily outsource the following talent groups:

These are the groups HRI Vietnam provides most frequently under the IT Bodyshop model.

Based on 2,000+ hiring requests and hundreds of IT Bodyshop contracts annually, HRI Vietnam assesses that developer hiring costs in Vietnam will continue to increase slightly in the next two years, especially for Senior, DevOps, AI/ML, and Data roles. However, compared to the Philippines, Malaysia, or Singapore, Vietnam still maintains a major competitive advantage thanks to strong talent quality, high commitment, and outstanding work performance.